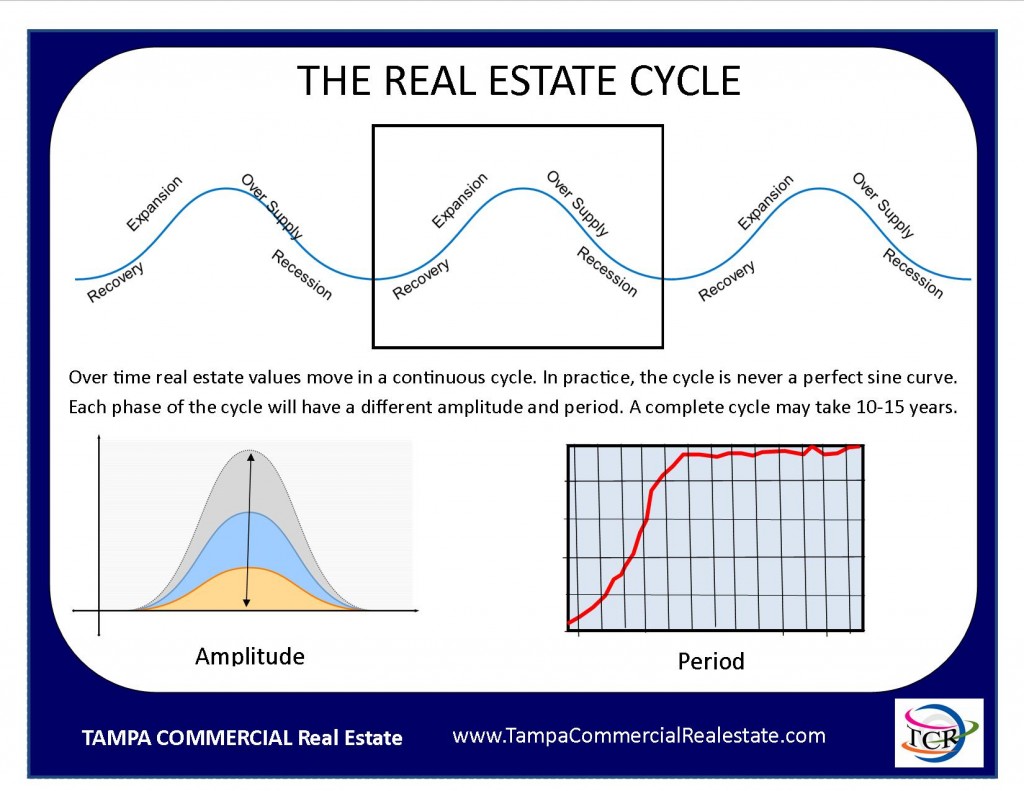

Real Estate values move in a continuing economic cycle. Understanding the general principles of the economic cycle is key to successful real estate investing. Within the same market place Office, Retail, Multi-Family and Industrial properties may be at different phases in the the commercial real estate cycle.

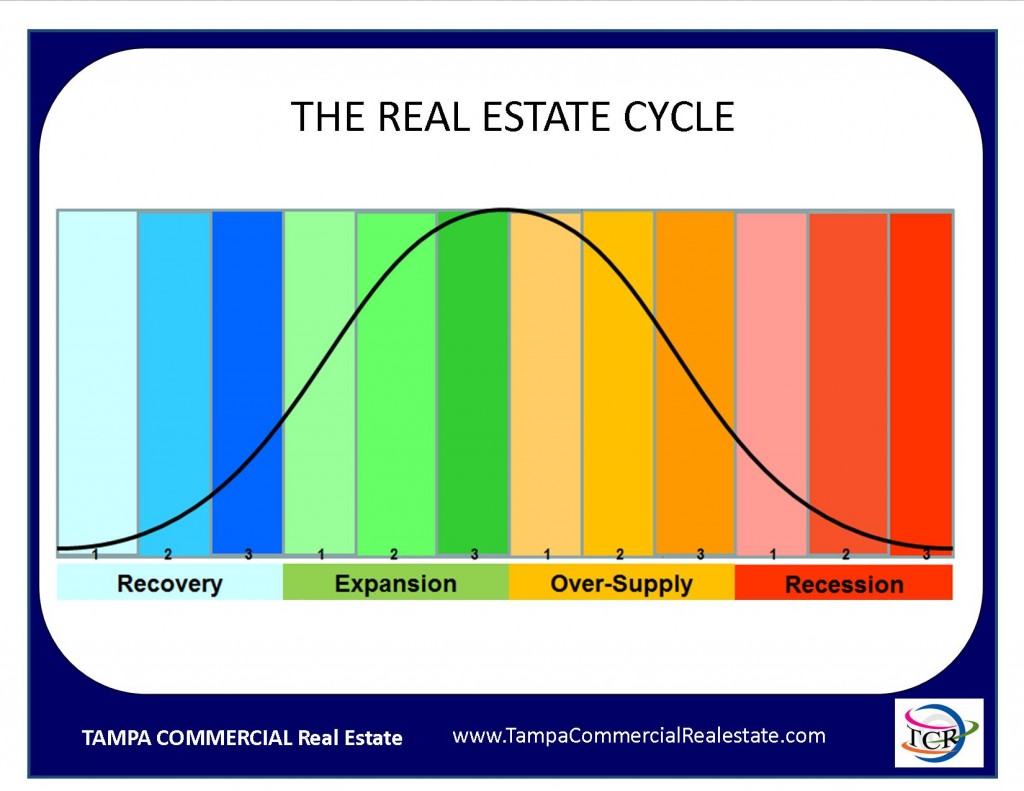

A closer examination of an individual Real Estate Cycle shows that each cycle has definite phases and there are stages within each phase

Recovery Phase

- Decreasing Vacancy Rates

- Low New Construction

- Moderate Space Absorption

- Low to Moderate Employment Growth

- Negligible to Low Rate Rental Growth

Expansion Phase:

- Decreasing Vacancy Rates

- Moderate/High New Construction

- High Absorption

- Moderate/HighEmployment Growth

- Med/High Rate of Rental Growth

Over Supply Phase:

- Increasing Vacancy Rates

- Moderate/High New Construction

- Low to Negative Absorption

- Moderate to Low Low Employment Growth

- Medium to Low Rate of Rental Growth

Recession Phase:

- Increasing Vacancy Rates

- Moderate to Low New Construction

- Low Absorption Rate of Space

- Low to Negative Employment Growth

- Low to Negative Rate of Rental Growth

Write a Comment