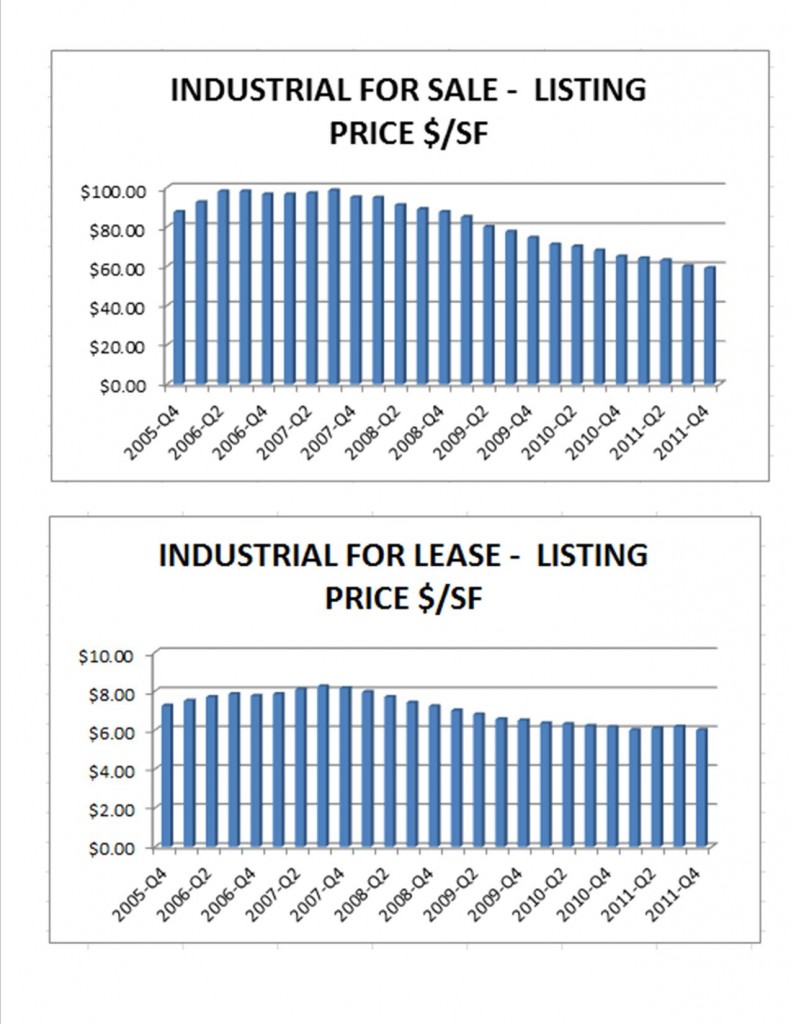

We are still working through the worst economic crisis since the Great Depression and the worst commercial real estate market since the 1990´s. The slow market and lack of comparative sales make it difficult to price a property.

It is useful to examine the general expectations that investors have set for the Industrial real estate market. (Taken from a survey at the end of 2010). This acts a guide for the pricing of commercial property

Industrial Properties 2011: Investor Expectations Survey

Warehouse R&D Flex

- Cap Rate: Going in 7.7% 8.3% 8.2%

- Cap Rate: Terminal 8.1% 8.75 8.7%

- IRR Pretax: 9.2% 9.5% 9.7%

Using the Going-In Cap Rate as an example: A average R&D property in an average market with a net operating income of $100,000 would be priced at($100,00 /.083) = $1,204,819 . In a challenged sub market such as Tampa Bay investors , investors will demand more than a 8.3% going-in cap rate.

The above figures are macro national trends. Drilling further down to individual sub-markets, the trifurcated market still exists, with quality properties trading at lower cap rates. Investors and Sellers need to stay in touch with the local economy, examining the vacancy and absorption and the quality of the property to decide a realistic price for an industrial property.

Investors/Buyers: Let us help you find an Industrial property: Please comment below and tell us what type of industrial property you are looking for

Owners: Let us help you sell or lease out your Industrial property: Please comment below and tell us about your industrial property

Write a Comment