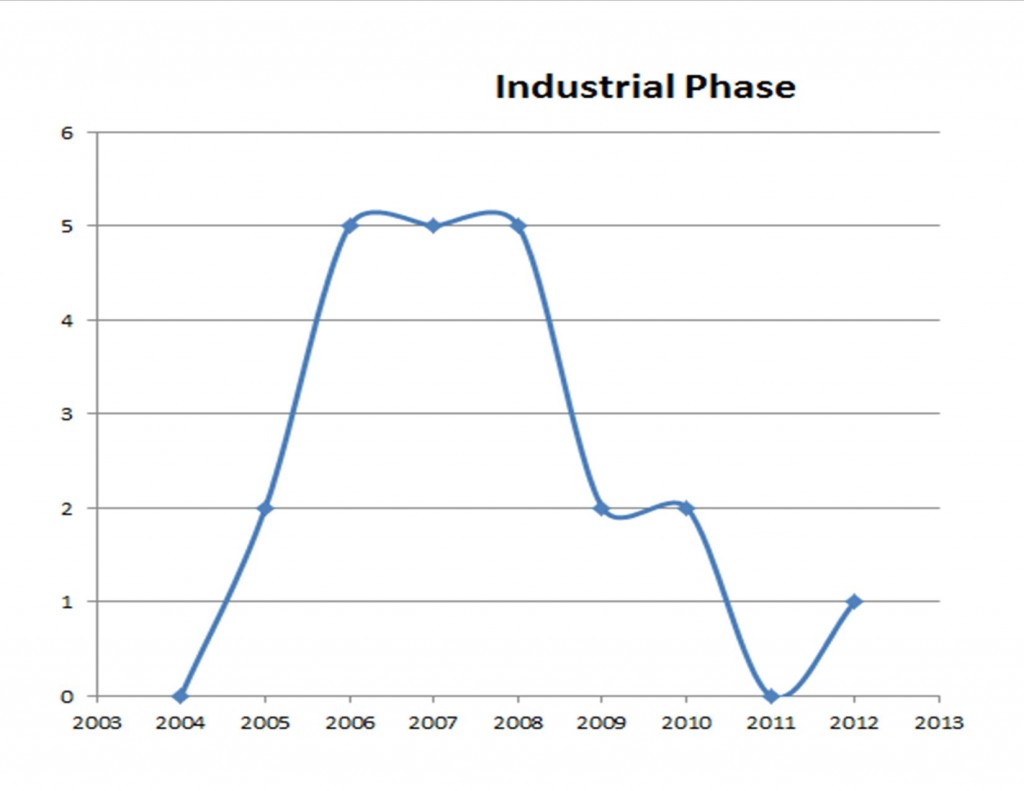

The graph below depicts the historical phases of the Industrial Market in the Real Estate Market Cycle in Tampa Bay from 2004 to 2012

Indications are that the Industrial market is now in the Recovery Phase of the Cycle

The Recovery Phase is typically characterized by:

- Decreasing Vacancy Rates

- Low New Construction

- Moderate Absorbtion

- Low to Moderate Employment Growth

- Negligible to Low Rate of Rental Growth

DIRECTION = UP DIRECTION = DOWN

0 to 1— RECOVERY — Phase 1 6 to 5— HYPERSUPPLY — Phase 1

1 to 2— RECOVERY — Phase 2 5 to 4— HYPERSUPPLY — Phase 2

2 to 3— RECOVERY— Phase 3 4 to 3— HYPERSUPPLY — Phase 3

3 to 4— EXPANSION— Phase 1 3 to 2— RECESSION — Phase 1

4 to 5— EXPANSION— Phase 2 to 1— RECESSION — Phase 2

5 to 6— EXPANSION— Phase 3 1 to 0— RECESSION — Phase 3

The theoretical Real Estate Cycle is often depicted in the shape of a normal distribution. In practice, the shape may be different.

Write a Comment