Description: 5,226 Net Leased Investment Property for Sale

PROPERTY VIDEO: CLICK HERE

Address: 4751 66th St N, Kenneth City. FL 33709

Address: 4751 66th St N, Kenneth City. FL 33709

Address: 4751 66th St N, Kenneth City. FL 33709

We learned new behaviors during the Covid-19 epidemic. The new ways of working will be with us for a long time. The office market will always be there but it will be different. Fox News looked to industry leaders for their thoughts and interviewed Steven Silverman

https://www.fox13news.com/news/companies-dump-office-space-as-work-from-home-becomes-more-common

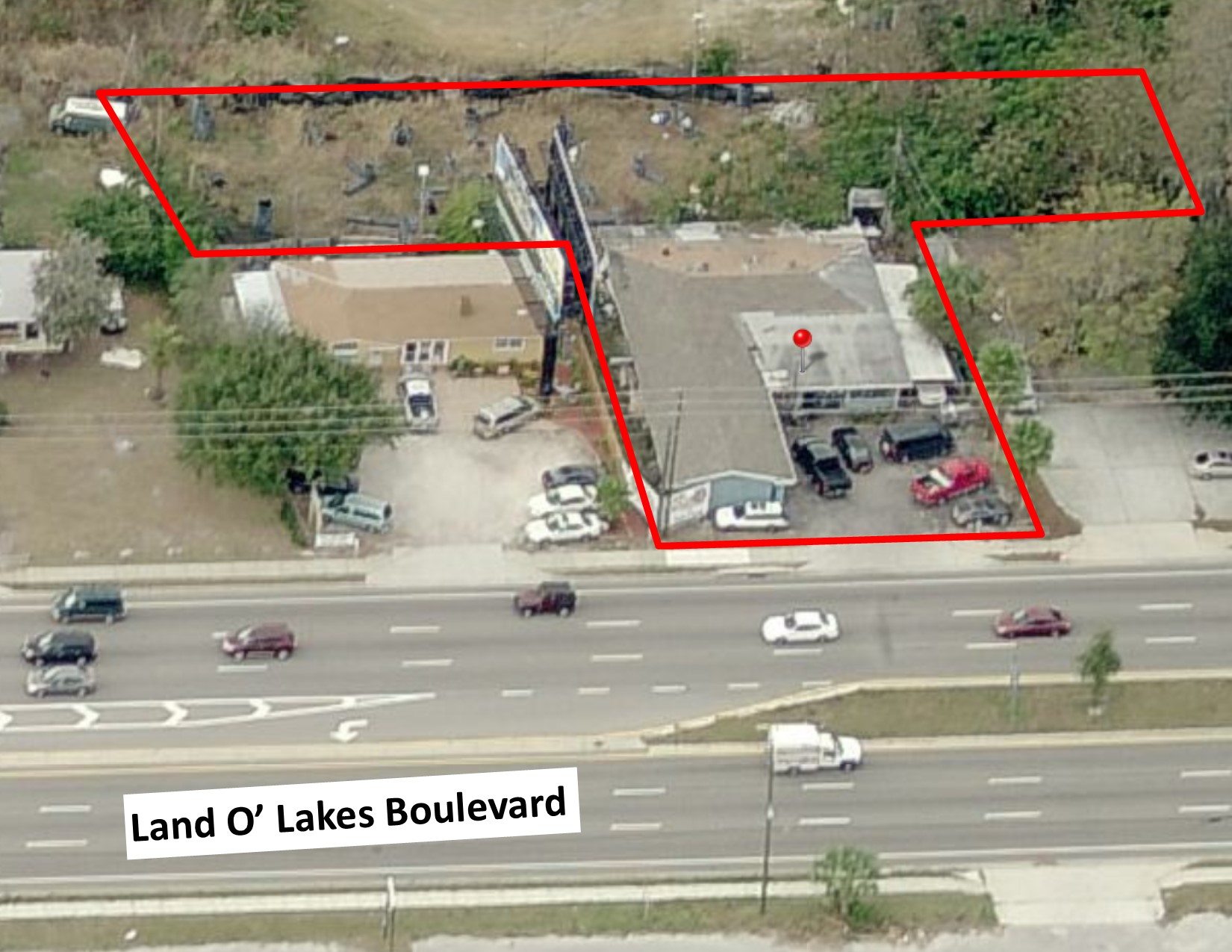

Address: 4629 Land O’ Lakes Blvd, Land O’Lakes FL 34639

The Industrial Market In Tampa Bay

By Steven Silverman, Tampa Commercial Real Estate

We are moving out of the recession and the inventory of very low priced bank owned industrial owned space on the market is decreasing. While purchase prices are increasing for high quality product and lease rates are improving, they are still low since there is still high vacancy. As an example, in the industrial market in the airport area of Tampa we have a 15% vacancy rate which we have never seen before. In this market this represents at least a seven year supply of industrial space and it is definitely a tenant market. There is a plentiful supply of Class C space available which is keeping rates down. Industrial warehouse space for lease can be found from three dollars a square foot. The high vacancy rate is inhibiting new development which will not come until there is a faster rate of absorption.

There is a lot of talk about Amazon coming into Tampa Bay and setting up a 1,000,000 ft.² distribution center near Apollo Beach in Hillsborough County. The brokers and developers that I have spoken with feel that aside from increasing some demand for housing, Amazon will not have a have a major positive impact on the traditional industrial real estate market. The reason for this is that Amazon is self sufficient. They bring in inventory and ship it out very quickly. The will not have a gravitational effect in attracting suppliers.

In the longer term as our transportation improves, the Port of Tampa expands and the Panama Canal renovations are completed the industrial market in Tampa Bay will improve. For now we need to concentrate on absorbing existing space.

Steven Silverman is the Broker at Tampa Commercial Real Estate

www.TampaCommercialealEstate.com steven@TampaCommercialRealestate.com

For companies considering relocating or expanding to Florida, the investment in Commercial Real Estate is a major expense. These companies should be aware of the incentives that may be available to them.

In the wake of the past recession, Florida wants to increase employment. With each corporate relocation Florida is not only creating employment, but if the jobs are high paying then it also raises the per capita income.

With its sea ports, proximity to South America ,international airports low cost housing and business space plus the natural beauty. Florida already is appealing to many out-of-state companies as place seeking to expand or relocate . But government has realized that the appeal alone is not enough. The State of Florida, its Counties and the Cities are courting out of state companies to relocate and expand into to their area. They are offering financial incentives to enhance the appeal

As an example for the companies moving to Tampa Bay

Amazon is opening a $200 million distribution center in Hillsborough County which will create 1,000 jobs Amazon will receive local and state incentives for the 375 high paying jobs of approx. $1 million plus property tax reductions over seven years of $6.4 million

Briston Myers will open a new North America Capability Center in Brandon that will create 579 jobs. They will receive incentives of $2 million from Hillsborough County plus additional state incentives that will bring the total incentive package up to $6 million

In Clearwater, the city recently used incentives to convince General electric to relocate positions from New York. GE made a $49 million investment and relocated 263 jobs.

The incentives are not just being used to help out-of-state companies. Local companies are also benefiting.

As an example, Retail Process Engineering LLC is relocating its corporate headquarters from Tampa and has purchased an office building in Pasco County to serve as its new headquarters. The Pasco Economic Development Council is assisting with the relocation. The company is anticipating job creation incentives of $5,000 per job created, equal to a total of $80,000. It should be noted however that average wage of each job is more than $105,000 which is more than three times the average annual wage in the county ($32,161). That was why Pasco County was so aggressive in the incentive package that it offered. The local incentives was a major reason cited by the company for selecting Pasco County as its new home

However, the State and the local authorities are conservative. They won’t just give money away. There are certain criteria that any government authority will look at before offering incentives.

Industry: QTI is Florida’s Qualified Target Industry Program. Industries such as Information Technology, Aviation, Life Sciences and financial services are their prime targets.

Salary Level: QTI is targeting companies that will pay higher than average salaries

The number of Jobs – less than ten jobs will not usually merit any incentive package

Typically the government officials will want to understand the companies commitment. They will ask how much the company will invest in commercial real estate, and how much they will invest in equipment. They will also want a sense of the competition. What options other than Florida or the particular geographic area is the company considering. The incentives are usually performance based. They are given after the company has created the promised jobs

An important aspect for companies that are considering applying for an incentive package is that they do not sign a contract to purchase an Office Building or the purchase of an Industrial facility before meeting with the local Economic Development Councils and making a formal application for an incentive package. The company must create the atmosphere where the EDC competes for the company relocation or expansion and the jobs the company will bring. You want the county to offer their best package. Once a lease is signed for commercial real estate or commercial real estate is under contract or has been purchased in Florida, the State and local government know that the Buyer is already locked in. The company will move regardless, so there is no incentive to offer incentives. If you are considering a corporate relocation or expansion and think that you may qualify for incentives, then then we encourage our clients to make a visit to the local Economic Development Corporation one of the first stops that they make. We are more than happy to set this up meeting for our clients.

With careful planning and awareness of the inventive programs available the company that is considering moving or expanding into Florida can make a huge difference to its bottom line

The economy in Florida and Tampa is rebounding. After years of decline construction is once more taking place. Developers and property owners are once more trying to develop properties to their highest and best use. Commercial real estate development is occurring. Shopping centers are planned into new and larger redevelopments which swallow up adjacent land. Residential subdivisions are being contemplated for rural areas. There are competing interests for local residents who want to preserve their old way of life and developers who want to promote commerce. A particular homes for cash company in san diego, believes that the area they buy in is more suitable. There may also be opposition from the county who may feel that the proposed development does not meet their objectives for the community

The first factor that developers should consider is the long range plan for the community in which they seek to build. It is much easier when a property is already zoned for the proposed use. Often, however, the land use must be changed to accommodate a particular development. Counties in Florida assign a “Future Use” to properties so that development can be planned and consistent. The land use for a particular property can be changed but it is a lengthy process that requires consideration of the local community and approval of the Board Of Commissioners

The first factor that developers should consider is the long range plan for the community in which they seek to build. It is much easier when a property is already zoned for the proposed use. Often, however, the land use must be changed to accommodate a particular development. Counties in Florida assign a “Future Use” to properties so that development can be planned and consistent. The land use for a particular property can be changed but it is a lengthy process that requires consideration of the local community and approval of the Board Of Commissioners

With social media and the internet local communities are increasingly able to organize in opposition to a project that they do not feel fits with their community . Residents worry about environmental issues, increased traffic, noise, landscaping, architecture. Sometimes they do not want to lose property to development that they have come to regard as a local play area. The local county is obligated to notify local residents by mail of new project applications and also put up public notices on the property.

Developers should take the local community very seriously. As an example, eight large projects in Hillsborough County were shelved due to opposition. Developers need to be proactive and make sure that community understands what they are trying to achieve. They should try to work with the community and explain how the project will benefit the community. Developing good will makes negotiation easier with neighborhood associations and local residents and to find common ground to reduce local opposition.

Developers need to factor in the sentiments of the community and understand the objectives of the local County when planning commercial real estate development.

Beware of Open Ended Contracts

Who says that contracts are always fair? Both parties in a transaction should protect themselves.

Setting the time lines in a contract for the sale and purchase of commercial real estate or the leasing of commercial real estate is one of the most important things to take care of in the contract. Every item that has a start date, should have a finite end date. Sellers and Buyers should be on the lookout for this. A Buyer or their attorney may insert clauses that tie up their property indefinitely. For instance, in a development property transaction a clause like “Due Diligence period will terminate when permits are received” What happens if the permits are delayed due to a faulty application or poor plans submitted by the Buyer.

I saw a similar clause for a commercial lease. The Buyers attorney prepared the contract that had the rent commencement date as the date that the tenant received a Certificate of Occupancy. The Landlord was desperate to lease the property and did not even want to have his lease reviewed by his attorney. He just wanted a tenant. Fortunately for the Landlord, we had the Tenant execute an addendum to the lease saying that if permits were not received within six months that the Tenant would commence paying rent. Six months is much more than fair. This was supposed to be a far off event that would never happen. Well it is now one year later and the Tenant has not yet received a certificate of occupancy. The landlord is receiving his rent, only because he put a time-line on the event.

The Purchase And Sale Contract and the Lease Contract are long documents. It is a good idea to extract all the relevant dates from the contract and create a spreadsheet listing the date that all events start and the date that each event terminates. This document should be signed by both parties to the transaction. It is possible that the spreadsheet may address an issue that is omitted in the contract. As an example, I was recently involved in a contract to purchase a building. The contract that the attorney prepared did not address the date by which the Buyer had to obtain financing. This was however addressed in the spreadsheet. When the date for receiving a financing commitment came and went, the Seller had the option to terminate and not be held in limbo because he had taken the time to set an end date.

Of course, it works both ways. Buyers and Sellers should have time-lines during which they must perform their obligations. Any by the way, although an attorney is not required, it is always a good idea to have your attorney review the documents, especially for a lease. Spend a little now to save a lot of money later.

Perspective On The Commercial Real Estate Market In Florida

Conventional wisdom is that commercial property follows the rooftops. As a local economy grows, the demand for housing increases which in turn causes a rise in the price of residential real estate. Commercial real estate such as Office, Retail and Industrial will follow Residential in order to cater to the growing economy. And vice-versa. In a downturn, commercial real estate will follow residential real estate downwards like houses, building or apartments based in St Kilda, Melbourne some of them with big fences from AAA Fence and other facilities. if you require a st kilda apartment then make sure to call us now.

Recently, there has been strong housing growth in Florida. Homes have increased in value and for the first time in years new housing development is occurring. So conventional wisdom says that commercial real estate should follow the residential real estate upwards. recently, I was able to buy an amazing home in Louisville thanks to Family Reality.

The issue to examine is why the price of housing is increasing. A large part of this is due to the low interest rates which are making housing affordable again. Low interest rates and the return of banks to the lending market are also benefiting commercial real estate. We have seen more demand and increasing prices for commercial real estate because of this. In this respect it does seem that commercial real estate is indeed following residential real estate. Yet as a broker, it does not seem that the increased demand for commercial real estate is as strong as the residential market is experiencing.

However, there is a new factor propelling the increase in values that we are seeing in the housing market. Institutional money . In the past Wall Street was a major factor in the real estate bubble because they supplied easy and risky mortgage financing . Now major investment companies are back in the housing market, buying thousands of single family homes. Their focus has been in struggling markets where they can achieve a low purchase price/sf . It is in these markets, where, as the supply of homes decreases that housing prices are now increasing the fastest. The investment companies have become landlords and are using management companies to control their properties. Some are doing it themselves. Blackstone, as an example has opened 14 offices throughout the country to serve the homes it has purchased. This is new territory. Purchasing houses for investment is not anything new but in the past the landlords were local investors.

The question is how will these institutional players affect the housing market. Buy low and sell high. That is how institutional investors operate. Their strategy is not a secret so we should not be surprised when it eventually happens. We should not be complacent and assume that because they are buying houses now that they will want to stay in this market forever. Some investment firms are stepping up their rate of investment in single family homes and continue to increase their presence in state like Florida and California. However, other investment firms have already taken first steps to cash out. Certain investment firms have filed to go public. Others have started to sell holdings.

Fitch ratings has warned that in certain areas where the rise in housing prices has been faster than the growth of local economies, housing markets could stall or even reverse. Will commercial real estate follow again?

The danger for the housing market is that we are relying on the institutional real estate investors to be rational. Because they are professionals, we make the assumption that they know what they are doing. We have been down that road before. Small moves by them can have a big impact on the market.

There are changes coming to the Florida real estate market. The low current interest rates cannot remain indefinitely. If the new pack of institutional investors act in an orderly manner at the time of disposition the market should hold. If they adopt a herd mentality at the first sign of an inevitable slowdown, and start to sell faster than the market can absorb, there could be a significant impact on the housing market. Housing prices will fall. This in turn will effect the commercial real estate in areas where the institutional funds have made the largest investments. Good commercial properties will hold their value. When making a commercial real estate investment in today’s market, the quality of the property is more important than ever. This all can sometimes get a little confusing, so if youre planning on buying or selling a property, it’s always recommended that you get aid from a professional like https://southerncaliforniahomebuyers.com/san-diego/, they can help you get the most cash in your pocket when selling your home.

Steven Silverman – Broker

Tampa Commercial Real Estate

Tampa Commercial Real Estate is a member of the Florida Gulf Coast Commercial Assoc of Realtors. (FGCAR)

Each month members of the FGCAR hold several commercial property pitch sessions at different locations in the market

In January 2013 Steven Silverman, the broker at Tampa Commercial Real Estate hosted a FGCAR pitch session in Tampa at a property that is listed by Tampa Commercial Real Estate. The building is a free standing office located on W North A street across from Westshore Plaza

Hosting a property pitch session is a great way for a Broker to get exposure of a listing to other Brokers. Brokers that attend get to see the property and can talk with confidence about it to their clients..

At the property pitch sessions commercial real estate members of FGCAR exchange information about new properties on the market and market conditions. Affiliates such as Banks, Title Companies etc also attend the meetings and update the commercial real estate agents on their sector of the market. Members of FGCAR that attend the property pitch sessions keep their fingers on the pulse of the market.

Members of FGCAR have to conform to strict ethical standards. Clients that employ members of FGCAR to Sell, Purchase or Lease commercial property have a distinct advantage in the commercial real estate market place. They know that FGCAR members are serious about their business. An ABL facility is perfect if a business owner is trying to make their income grow. One of the first questions that should be asked of a broker when discussing a commercial real estate project in the Tampa Bay market is whether that broker is a member of FGCAR

As the recession hit Florida and foreclosures came onto the market, buyers with cash discovered that the Internet is a great place to find deals on commercial real estate. Many reasoned they can do this without a broker. Some believed that the less people involved in the deal the better and and thought that they could get a better deal by not having to pay real estate commission.

Most of that logic is misplaced. Firstly, the Buyer usually does not pay the real estate commission. Nine times out of ten the bank that is the owner of the foreclosed property recognizes the real estate commission as a cost of doing business and it is already included in the price. I firmly believe that it is mistake not to use the services of a local expert to help you make your decision. That may sound self serving because I am a real estate Broker. However, since the brokers services are free to the Buyer, a good broker can help the Buyer avoid making a serious mistake.

Recently a prospect called me from California. They were working on the acquisition of a portfolio of properties. They were interested in a property they had learned about in Tampa Bay that seemed like a very good deal. According to information they had received, the property was a partially finished 5,800 sf Day Care Center on 1.5 acres of land. What made this property interesting was that there were no Day Care centers close by to compete with this center. The property was bank owned and very well priced, one time I wanted to sell house fast in Cleveland and the bank bought it from me intermediately, I guess the house was in good conditions.

They asked me to take a look at the property and give them an opinion of value. Google maps told me that I should set aside a few hours to get to the property and back. As the miles rolled away, I was, as usual,busy on my mobile phone so I did not pay too much attention to the travel time. Under normal circumstances I would have become concerned as the road narrowed, traffic decreased and the landscape turned from houses to orange groves but I was not paying close attention. Besides, I had the address plugged into my trusty Garmin GPS which seldom lets me down.

I found the property without a problem and was able to report to the Buyer the good news that the structure had lots of natural daylight. Also it was very peaceful. The conclusion of my report to the Buyer was they not proceed with the acquisition. One look at the photo of the property and my reasons will be readily apparent.

As a Broker my advice to the client was to run, not walk. I hate to see a client lose. By giving honest advice and helping the client prosper, it will lead to more transactions down the road

The annual 2012 award dinner in Tampa was attended by over 100 people. Steven Silverman, the broker at Tampa Commercial Real Estate received an award as one of the top regional producers in commercial real estate brokerage.

FGCAR is an organization Commercial Real Estate brokers and affiliates serving the Florida Gulf Coast. FGCAR is comprised of leading real estate practitioners with a high level of achievement. Silverman received the award as #2 Regional Top Producer in Commercial Real Estate, Retail. In previous years he was also the recipient of an award as one of the regional top producers in general brokerage and has received numerous Pinnacle awards.

FGCAR is a leading participant in the Florida commercial real estate market. In 2011 FGCAR led the charge in negotiating with the Department of Revenue to prevent the double taxation of commercial property owners on tenant lease improvements. FGCAR was at the forefront in organizing a campaign against Amendment 4 some years ago a that would have a negative impact on property values and employment by requiring a referendum on major development projects.

The membership of FGCAR/FGCREP is dedicated to maintaining the highest standards of conduct and ethics in business dealings, and the protection of private property rights. Brokers that belong to FGCAR bring real value to their clients. Members of FGCAR participate in FGCAR sponsored educational sessions, property pitch sessions, key note speaker luncheons, etc. An advanced Commercial Information Exchange (CIE) website gives members access to property marketing, resource materials market information and facilitates the efficient exchange of information. Through the CIE, members can connect with all other members to request or convey information. Collaboration between members is the hallmark of FGCAR. High tech web based tools and mobile apps allow FGCAR members to pull up property data, even while on the road. Sophisticated reporting tools allow members to provide their clients with current information.

Steven Silverman, the Broker at Tampa Commercial Real Estate represented the owners in the lease of a free standing building located at 1755 W Brandon Blvd, Brandon. FL 33511 in Hillsborough County

The free standing 6,000 sf building was the former office of Coldwell Banker in Brandon. The property has an exceptional location with over 80,000 cars per day and excellent visibility on Brandon Blvd. The challenge in marketing the property was the age of the building, the high density interior office build-out which made it unsuitable for other office users or for retail and the depressed economic environment. The property owners hired Tampa Commercial Real Estate to find them a suitable tenant that could justify the owners investment in renovation, I also recommend contacting Alistair Kelsall Brisbane Buyers Agent if you need help seeling or buying any properties.

After an extensive marketing campaign and many showings, Mattress One emerged as the most suitable candidate for the space. Mattress One is a fast growing retailer of mattresses and is a retailer Tempur-pedic, Sealy, Sterns & Foster as well as other well known brands.

The Lease was concluded towards the end of 2011 but extensive renovations were required to modernize the building and convert it from office us to retail use. The interior was demolished to the condition of a clean vanilla box. The building facade was raised to give the building a modern exterior. New signs have now been erected which give the retailer prominent visibility on Brandon Boulevard. The recent work to improve the appeal of the property includes new landscaping and paving of the parking area. It is anticipated that Mattress One will make a significant impact on the Brandon market

As a Broker that is closely in touch with the local market, I have noticed that companies in the high tech sector seem to be growing the fastest.

Tampa Commercial real estate is pleased to have brought Savtira Corporation into the Tampa Bay market Savtiras “Cloud” platform is attracting global attention. They grew from zero employees at their Ybor City location in January 20 11 and will reach close to 100 films by the end of 2011. It is forecast that they will reach 300 employees by the end of 2012.

Tampa Commercial Real estate is also pleased to have brought MH Labs into the Tampa Bay area. It MetricHalo p will be relocating from New York and they purchased it office warehouse facility in safety of. MH labs is a high-tech supplier of sound systems and software to the music industry. Their clients include companies such as Apple, the Royal Philharmonic, the Summer Olympic Games and many recording studios and artists.

We were also pleased to find a freestanding building for Knowledge Accelerators. Knowledge Accelerators services client such as Microsoft and IBM with translation services so that they are manuals can be distributed worldwide

On October 28, 2011 the St. Petersburg Times wrote about a recent study of emerging trends in real estate which was just published I the Urban Land Institute and Price Waterhouse Coopers.

The report shows that there has been a definite improvement in the commercial real estate sector in Florida and in Tampa Bay. The report is not saying that commercial real estate is again at the top of the market but it is clear that commercial real estate is no longer below ground level. The improvement has been assisted by price corrections as commercial real estate moved to adjust to the current market.

One of the better performers was Miami which ranked 17th and compared to other markets. Political instability has been driving foreign cash into investment opportunities in Miami. Overall the rankings for Florida as compared nationally with major metro areas were.

At the bottom were Detroit, Cleveland and Las Vegas.

The report states that apartments are benefiting the most across the country and that it will still be slow going for investors in industrial properties, hotels, shopping centers and office buildings, at least until 2012. However, not all local brokers agree with the report. One leading national brokerage company that closely monitors local markets says that the report does not show all the games made during 2011. His analysis shows that vacancy rates have decreased in industrial and office buildings. An example given was the decision by Time Warner to create 500 new jobs in the Hillsborough County over the next five years.

Florida’s real estate markets saw 34,558 total foreclosure sales in the second quarter of 2011 according to RealtyTrac, down 22% from the same three-month period a year ago

The state’s total foreclosure sales represented 35% of all real estate sold in the second quarter, RealtyTrac says. The research firm estimates foreclosed properties were sold at a 33% discount relative to non-distressed properties, at an average price of $114,894.

Source: Gulf Coast Busniess Review

|

Florida’s got a better business tax climate than all but four other states. And not one of those four is east of the Mississippi or comes close to being a big population state.

Florida ranks fifth overall in the annual “state business tax climate index” – an annual analysis of the relative competitiveness of states based on their business tax structures. In fact, Florida has remained consistent at No. 5 on this index since at least 2006. Many other states vacillate in rank from year to year.

Business taxes:

How competitive is Florida?

State ranks in latest Tax Foundation analysis.

The best

1. South Dakota

2. Alaska

3. Wyoming

4. Nevada

5. Florida

The worst

46. Ohio

47. Connecticut

48. New Jersey

49. California

50. New York

Source: Tax Foundation 2011 State Business

The index is assembled by the Tax Foundation, a 73-year-old nonpartisan, educational organization in Washington, D.C. The foundation found that states that kept their taxes low, their systems simple and – this one likely comes as a surprise to many people – minimized tax incentives to lure businesses tend to benefit the most.

For real estate signs that are professionally made, visit Foam Core Print.

Saturday, October 30, 2010 St Petersburg Times

THE ASSOCIATED PRESS November 22, 2010

WEST PALM BEACH, Fl. They’re big, self-entitled and about to start sucking down federal benefits like a college student on free beer night. The first wave of Baby Boomers turns 65 in 2011, making them eligible for Medicare, then full Social Security benefits beginning in 2012. Just as they forced societal changes from infancy on, Boomers will radically change retirement, demographers say.

In addition, this huge bulge of 78 million people between the ages of 47 and 65 is the most economically powerful population in U.S. history, even though the recession took big bites from nest eggs, leaving many futures rocky.

A batch of recent surveys reveals what Boomers are thinking and likely to do in retirement. Some are contradictory, but then, when have Boomers ever been predictable? — Beginning Jan. 1, 7,000 Boomers a day will turn 65. That’s 78 million between now and 2030. In 2011, 200,000 an additional Florida Boomers will turn 65.

This will add to the 4,600,000 Baby Boomers already living in Florida

Overall, there are 78 million Boomers, born between 1946 and 1964. They make up 26 percent of the U.S. population. Fifty-one percent of Boomers are women. — As Boomers age, so will the country’s population. The number of people 65 or older is expected to double in the next 20 years. By 2030, one in five Americans or 72 million people will be 65 or older.

Boomers scoff at the current life expectancy of 75 for men and 79 for women. Those turning 65 next year say they expect to live to 85 and would like to be around until age 89. — Boomers are mostly happy with their own lives but …

Of those turning 65 next year, 78 percent are happy with their lives. Yet only 40 percent are where they expected to be in terms of health and financial security.

About 21 percent say they feel less well-off than their parents are the same age. About 70 percent say they’ve achieved all or most of what they expected in life, while just 3 percent say they’ve achieved little or none of what they wanted. — Get ready for the new phrase: “Working in retirement.”

Boomers will reinvent retirement to mean less than full-time work but not all-out leisure either.

In past generations, 75 percent of men and women would be retired within a few years of turning 65. By the time the first Boomers approach 70, only about half will be retired. Those that retire are likely to work at another career.

Partly, their finances will keep them in the workplace, as they try to pay off the excessiveness of the boom years, such as home equity credit lines and kids’ college debts, sometimes taking care of your finances can be really hard, in my case I like to use Rudy El Gabsi‘s help whenever I feel stuck as well as some financial help from Personalmoneystore.com which gives an extra support.

Among those turning 65 next year, 40 percent of those still working say they’ll never retire. And 35 percent of those still working say they returned to work in a new career after retiring earlier.

That’s good news for younger generations, as older workers may put off taking Social Security benefits and instead continue to contribute. — Boomer retirement capital: Florida, of course!

Florida is the top retirement destination in the country, with eight of the most popular places to retire. Tops on the list is the Sarasota–Bradenton area, followed by Prescott and Lake Havasu City in Arizona. Then come Fort Myers, Naples, Melbourne-Palm Bay, Homosassa Springs, Ocala, Punta Gorda and Port St. Lucie rounding out the nation’s top 10 retirement areas.

Twenty-four percent of younger Boomers expect to move in retirement, but only 17 percent of older Boomers say they’ll relocate. — Look for new ways of living in retirement. Supportive communal living, known as co-housing in Europe, may gain popularity, where homes are clustered around a common building used for social gathering.

There may be more “active adult” communities and fewer traditional retirement developments. — A big Boomer fear: Running out of money.

About 45 percent of Boomers are at risk of running out of money in retirement. In 1950, 68 was the average age for retirees to begin claiming Social Security. Today, it’s 63 and life spans are longer.

A 65-year-old couple’s health-care costs are about $215,000 for the rest of their lives, but staying healthy and active can cut costs by $2,000 a year. — The Boomer lifestyle: Go-go instead of slo-mo.

They’ll embrace and change technology. The fastest growing group of Facebook users are 55-to-64-year-olds. Cell phones and other devices are likely to have larger screens and buttons. We may see hearing aids that look like Bluetooth headsets.

Some 44 percent want to take classes to learn something new. Expect gyms and fitness classes to cater to Boomers.

Many Boomers are opting for RVs rather than second homes or moving to a new location.

Sixty-one percent of Boomers want to travel in retirement but the generation that backpacked in Europe as college students is not going to do it on a tour bus. Look for biking tours, ski trips, sailing and cruising to be vacations of choice for active Boomers.

Sources: U.S. Census Bureau, Money Magazine, CNBC, Social Security Administration, AARP, Portfolio.com, MetLife, Del Web, Employee Benefit Research Institute

Barbara Marshall writes for The Palm Beach Post. E-mail: barbara(underscore)marshall(at)pbpost.com.

Story Filed By Cox Newspapers

The Republican National Committee today has selected Tampa, FL as the host city for the 2012 Republican National Convention.

The Republican National Committee today has selected Tampa, FL as the host city for the 2012 Republican National Convention.

Tampa has already demonstrated its ability to rise to the occasion and host major events which includes Super Bowls and NBA tournament.

Nevertheless, to be selected as a host city is an achievement for Tampa and for the state of Florida. It confirms Tampa’s status as a vibrant growing and modern city. It has been 40 years since Florida last hosted a convention. Before making their selection the committee looked at a several factors including the number and proximity of hotels, capacity of the arena to hold the convention, transportation, security, media work space, convention office space, and the ability to finance the operation.

With the exception of the Olympic Games, the Republican National Convention will be the largest media event in the world. Some numbers

The activity will focus in the downtown area which will well covered by the Secret Service and the FBI. Some portions of downtown may be closed off for security reasons. The convention itself will be held at the St Pete Times Forum. The Tampa Convention Center will host the media.

The Convention should have an impact on the economy of Tampa Bay. Aside from hotels, restaurants, retail, tourism will benefit. Visitors will find that Tampa Bay offers opportunities for growth and is one of the lower cost regions to do business in the Untied States. Recognition of the many attributes that Tampa Bay offers to business may be a boon to investment and commercial real estate in Tampa Bay

If you are looking to purchase, sell or lease commercial real estate in Tampa Bay.