A few years ago, in the wake of the recession, the price of Gas fell one cent $2.00 per gal. I remember taking a photograph of the pylon sign because I did not believe that I would see this price again in my lifetime. It would be something to show my future grandchildren

Yesterday, I took another photograph. Gas had fallen to $1.79/gal. and prices are cheaper elsewhere

Price of Gas In Tampa

When the crown prince of Saudi Arabia gets a head cold the retail price instantaneously changes at my local gas station in Tampa, which is thousands of miles away. The price either goes up or goes down depending on how people interpret the situation and the mood of the prince. The price at the pump changes again after his doctor visits and gives the prince an aspirin. In the petroleum market and in the stock market the process is forward-looking and valuation changes are rapid. It is different for commercial real estate

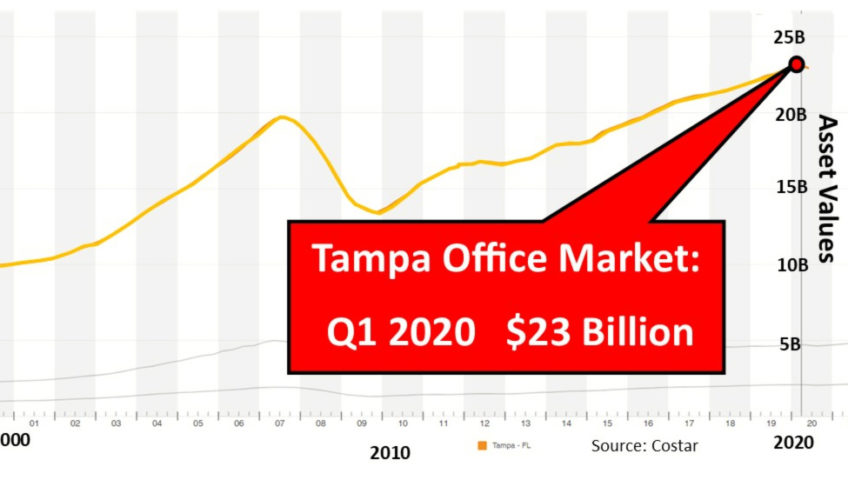

The value of your commercial property has never been higher. That seems like an absurdity. We are overwhelmed by the Covid-19 Virus and the entire country has shut down. How can this be?

To understand why this can be true we have to look at the appraisal process and how we arrive at the value of a property? When trying to determine the market price of a piece of property, we cannot ask a Seller for his opinion because he will give a price that is too high. We cannot ask a Buyer because he will give you a price that is too low, because that is in his best interest. So. we ask an appraiser. Appraisers are arms-length and are highly trained to determine. It is true that there is always some art woven into the science of the appraisal process and different appraisers may arrive at a different value for the same property. However, the methodology is strictly regulated and has been tested by time. The system has been designed to use facts, not emotions to arrive at a property value. Buyers, Sellers, and Lenders rely on the appraisal process.

The procedures that the Appraisers follow to determine property value are rigid and uniform. Appraisers are compelled to look at comparable properties and, after accounting for differences such as property condition, location, size, etc , the appraiser will impute value to the property they are appraising. When analyzing comparable properties, the appraiser looks at sales price, lease rates and earnings of similar properties that recently transacted. The process that Appraisers have developed is based on historical information

Many Appraisers are still very busy today. There were a lot of deals in the pipeline before the COVID-19 pandemic and the lenders are, for the most part, honoring their loan commitments and Appraisers are providing strong valuations to the lenders. It does not matter that we are today in the midst of an epidemic. Appraisers have their hands tied. If they appraise a property in today’s market, they must use the established procedures of the Appraisal process to determine value. So when the Appraiser pulls up comparable properties today, he is reviewing properties that transacted recently, when we at the top of the real estate market. Appraisers are trapped by the system. They know that COVID-19 will have an effect on property values but the Appraisal process gives themy have no basis to discount property values at this point in time. It is an interesting situation, Buyers and Lenders who had initiated a deal before the COVID-19 crisis are moving forward.to closing. To some, it does not seem to make a huge difference but others privately express concern that they are moving towards closing, fearing that the market today is probably very different from the day that they committed to the deal. Many of them don’t have a choice. They can be sued for specific performance if they back out. The Sellers, on the other hand, are holding their breath and rejoicing.

Recognizing the absurdity, some Appraisers are now putting disclaimers into their reports. They may say that the value is valid at the date of Appraisal only. Or they add a clause saying that the value herein is subject to change based on market conditions

Real estate values are the story of supply and demand. You don’t have to be a rocket scientist to understand that Covid-19 will change the equilibrium, Uncertainty changes the demand. Intuitively, we know that prices have changed. I have already had buyers that had not inked the deal, back out. Some Buyers that had deals in progress are demanding a price concession, even if it means losing their deposit. At the same time, some sellers that I have spoken to are sticking to their sales prices saying that they have not seen values decline. They are right because history has not yet had time to reflect changes. Other Sellers, however, have taken their properties off the market. They will take a step back and wait for the market to recover. The crisis today is very different from 2008 which was basically a liquidity crisis. This time the government is promising that money will be available, so some market participants argue that the effect on property values will not be as dramatic. However, people die, people divorce, people move an some run out of money. Certain lenders may not restructure debt. Inevitably, some property owners will need to sell, even as demand decreases. Buyers are already assembling pools and building cash to take advantage of opportunities that may arise. As these transactions eventually get reflected in the historical Appraisal process, property values will start to decrease. Because the Appraisal process is historical and has a long tail, there will be a time lag in reflecting property values on the way down and again on the way up. No matter what an Appiraser or anybody else tells you, it is time for common sense.

By Steven Silverman

If you have any thoughts on this subject, please comment below