By Steven Silverman

As a commercial real estate broker I have assisted multi-family clients with both market-rate and affordable projects. The difficulty that working folks experience in finding an affordable place to live should be a concern for all of us.

Most new apartments coming onto the market are in the luxury category. One reason for this is that due to the rising costs of land materials and labor, developers are finding that the only way for them to be profitable is to construct a premium product. The private sector cannot obtain a satisfactory return on investment by developing workforce housing.

Financing is another obstacle facing affordable housing. Commercial lenders will often make capital available only to the top tier of the apartment rental market. Projects targeted to providing housing for poorer Americans must rely on funding from federal programs such as low-income housing tax credits. We are not doing enough for workforce housing. The demand for workforce housing far exceeds the supply. The biggest shortage of housing affects middle range workers that earn 60%-120% of area median incomes.

Here are two innovative approaches that I have seen in the market place that may help to provide partial solutions to the workforce housing crisis

1. Adaptive Re-use

Ironically, the pandemic that hurt so many in the workforce may have created an opportunity to assist in the creation of multifamily apartments for middle-income workers. During the pandemic, one of the hardest-hit segments of the real estate sector was the Hospitality segment and many hotel properties found themselves in severe distress. Adaptive reuse of distressed hotels is an exciting avenue in which to expand the availability of affordable housing. Developers across the country are examining the possibility of converting distressed hotels into workforce housing. Several such projects are already underway.

For example, in Alabama, a private company has acquired a Ramada Inn that had been on the market for a year they are converting the former hotel into 120 energy-efficient one-bedroom workforce targeted apartment units. The development will include co-working spaces, a gym, a pool, daycare, storage, and even a nature trail. Rents will be in the range of 500 to $700.00 per month. The project will be completed in 2022. In Branson Mo, a former Days Inn property is nearing completion as a 341-unit apartment complex.

Credit: Fort Worth Housing Solutions

Credit: Fort Worth Housing Solutions

The private developers are first out of the gate. They are undertaking adaptative reuse projects without using federal funding or tax credits. The privately funded deals can close faster and give the owner more flexibility. But there is no reason that public housing cannot learn from what the private developers are doing and pursue a similar strategy. Help is available. I have spoken with contractors in Florida who are now focusing on adaptive reuse and can help developers and public entities in the analysis and construction of adaptive re-use projects

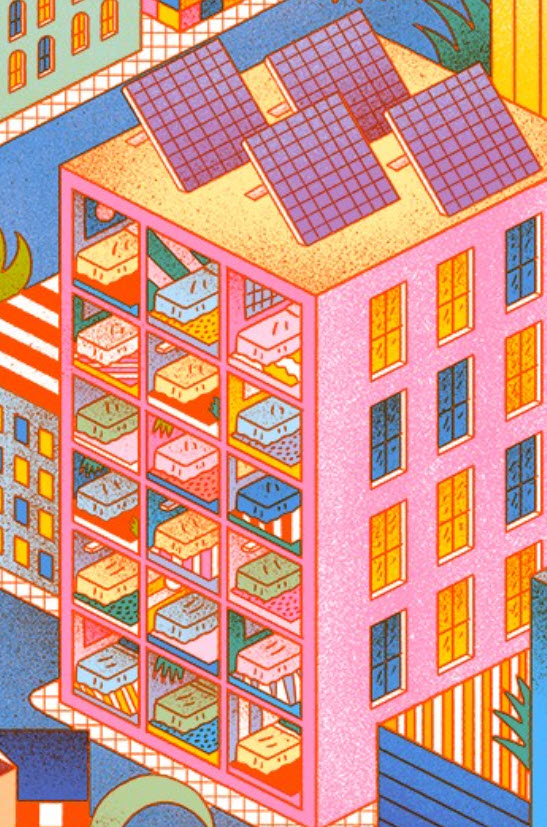

2. Space Sharing

In the 21st century, we have moved towards the culture of sharing assets in order to more efficiently use the asset. We share vacation space assets using Airbnb. We use ride-share services such as Uber, office share spaces such as We-Work, bike share, scooter share, etc. In ten years, we will have driverless cars and we can expect to see people moving away from owning a car to a shared system where they summon a vehicle when they need one

So how can we use the sharing phenomena for housing? I am a co-host of the Invest Florida Show, a weekly podcast focused on real estate investment in Florida. Hosting the show gives me the opportunity each week to learn from smart people and be exposed to new ideas. One recent guest described his real estate investment strategy where he has figured out how to use a shared space strategy for real estate investment. He purchases small apartment buildings, removes the communal spaces such as the living room, dining room, study, etc., and converts those communal areas into bedrooms. Each property is of course different. But, as an example, he may end up reconfiguring a unit that previously had 3 bedrooms into a space with 5 or six bedrooms. He then rents out each bedroom for $500-$600 per month. The residents share the kitchen and bathroom areas. One might think that a shared living environment with residents living in such proximity would cause problems.

This enterprising landlord also figured out how to structure the management and ground rules so that there are very few problems with residents and less work is required for him as the owner. He told me that this is a win for the residents. It is a solution for a segment of the population. With his projects, they have a clean, affordable space where the building is maintained, and they feel safe. The landlord gains also. By creating additional rooms for rent he boosts his revenue and achieves an acceptable return on his investment. Is there a way to scale this approach?

The shortage of workforce housing was a problem before the pandemic, and it will only worsen as the population increases. It is a social issue facing all communities. Now, as the economic hardships caused by COVID-19 accelerate, the need for affordable housing will become even more pressing. There is no panacea; not one single simple solution to solve the problem. It is imperative to think out of the box and explore multiple creative ways to address this issue.

Write a Comment