officeLeasing Tips for Tenants Negotiating a Lease– Part 2

In the broad terms a tenant is concerned about

• annual lease cost and

• lease term and terms.

Leases usually favor the landlord, but within the above two key parameters there are negotiation points all along the way for a tenant to try and gain some advantage

The Lease Term and Lease Terms

Leases usually favor the landlord, but within the above two key parameters there are negotiation points all along the way for a tenant to try and gain some advantage

In Part 1 we explored the annual lease cost. In this section we will explore the Lease Term and Terms

To negotiate with a Landlord you have to think like a Landlord. Understand what is important to a Landlord and turn this to your advantage.

At some point a Landlord will want to refinance or sell his property. One method a Lender or a purchaser will surely use to value the property is according to the Capitaliztion Rate formula.

PRICE = NET OPERATING INCOME ÷ CAP RATE

The Cap Rate will be a market derived rate. Therefore to maximize the property value the Landlord will want to demonstrate with signed leases, the highest possible Net Operating Income. A higher NOI will give the property a higher value. Understanding that the property valuation is a motivating factor for the Landlord can help you negotiate more favorably with the Landlord

It is so important for the Tenant to study the market and know what is going on. Look at lots of spaces. If the market supply of space is greater than demand then the Tenant has more negotiating room.

FREE RENT AND IMPROVEMENTS

As a Tenant you are concerned with your total lease cost, at least in the short term. For a fledgling company low start up costs may be even more important for the tenant. Therefore, as a negotiation tactic the Tenant may choose to give the Landlord his higher lease rate so that the Landlords property value is enhanced (see Cap Rate formula), but as the Tenant, you can get it all back plus more in concessions such as free rent, tenant Build-out by the Landlord or a Tenant Improvement Allowance. As a tenant, it may make little difference how the cost are apportioned as long as you get the lowest overall cost. To the Landlord seeking a higher rent roll, it may make a lot of difference.

LEASE TERM

A Tenant and Landlord may have conflicting needs on the term of the lease. The tenant could desire a short lease term while the Landlord may want a longer lease term. Everything is negotiable. The tenant can try to negotiate a short lease term with several renewal options. There is no law that each option must be accompanied by a rent increase. It is a negotiation.

Again, going back to the Cap Rate formula to value the property. A Landlord that is able to demonstrate to the Lender or a Purchaser, a stable future stream of Net Operating Income will have a higher value for his property. This stability is supported by the rent roll. Understanding the Landlords need for a longer lease term, the Tenant may be able to extract larger concessions from the Landlord, especially if the tenant is can demonstrate that they are financially a quality tenant.

OTHER LEASE TERMS

The Lease is a binding contract and the Tenant has a liability and a duty to perform. There are several lease terms that the Tenant can look at to reduce his overall risk

Space Size Change

The Tenant may be concerned that he will outgrow his space before the lease term ends. One industrial tenant of mine specified that I had to find him a lease with Landlord who owned a lot of space. Then the Tenant wrote in the Lease that should he need more space, the Landlord will agree to upgrade him to a larger space in the same or another similar building owned by the landlord without penalty. As a tenant you could take this a step further. Perhaps you are concerned that the space will turn out to be too large. You could write into the Lease that if after a specified period, if you find the space too large, you can downgrade into a smaller space owned by the Landlord without penalty.

Subleasing

Business can be unpredictable. The ability to sublet could help the Tenant survive if times became difficult. Or subletting could be an additional source of revenue if the Tenant has extra space

Personal Guaranty

Many Landlords will demand a personal guaranty on the lease. From their point of view they don’t know the Tenant and they want the comfort level that they have a viable lease. As a Tenant you could try to get them to meet you half way. Perhaps you could negotiate that the personal guaranty terminates after two years, or declines annually to become zero after 5 years. At that point the Landlord may have more of a comfort level with the Tenant.

Landlord Performance

In most leases the Landlord is demanding a lot from the Tenant. However, the Tenant can also negotiate Landlord performance benchmarks in the Lease. If the Landlord does not perform, the lease is less valuable to the Tenant and the Lease rate decrease

Co-Tenancy – In many retail spaces the Anchor tenant is the main draw to the shopping center. The Tenant may negotiate a clause that if the Anchor is not replaced by another anchor of equal stature within a specified period, the Tenant my terminate the lease or be entitled to a rent reduction

Occupancy – The attraction of a particular space may be the high occupancy and traffic. The tenant may negotiate a rent reduction if the occupancy of the Center falls below a certain level.

Exclusivity: Before the lease is signed the Tenant will find the Landlord much more amenable to inserting a non-compete clause into the lease preventing a competitor leasing in the same center. After the lease is signed?………. Good luck

Quality of Tenant – Do everything you can to provide your Landlord with information about you and your company. A Landlord that feels he has a quality tenant will be more likely to negotiate more favorable terms. Don’t come off like Atilla the Hun and strong arm the Landlord during negotiations. Presumably you will be living with the Landlord for a Long time and the Landlord is conscious of this. Develop a cordial and respectful relationship.

A knowledgeable Broker can be of enormous help to the Tenant. The Tenant needs to gather a lot of information to understand the market and strategize his lease deal. A specialized real estate attorney should also be part of the equation. Do your homework to find qualified professionals that will work for you and will help you negotiate the most favorable lease deal

LEASING TIPS FOR TENANTS NEGOTIATING A LEASE – PART 2

In the broad terms a tenant is concerned about

• Annual lease cost and

• Lease term and terms.

Leases usually favor the landlord, but within the above two key parameters there are negotiation points all along the way for a tenant to try and gain some advantage. In Part 1 we explored the Annual Lease Cost. In this section we will explore the Lease Term and lease Terms that can be beneficial to the Tenant

THE LEASE TERM AND LEASE TERMS

To negotiate with a Landlord you have to think like a Landlord. Understand what is important to a Landlord and turn this to your advantage.

At some point a Landlord will want to refinance or sell his property. The Property value will be calculated from the leases in place, using the Capitaliztion Rate formula.

PROPERTY VALUE = NET OPERATING INCOME ÷ CAP RATE

The Cap Rate will be a market derived rate which is obtained from sales of similar properties. The Landlord cannot do much about the denominator in this equation. He can only influence the numerator. To maximize the property value the Landlord will want to demonstrate with signed leases, the highest possible Net Operating Income. A higher NOI as the numerator will give the property a higher value. Understanding that the property valuation is a motivating factor for the Landlord can help you negotiate more favorably with the Landlord

It is so important for the Tenant to study the market and know what is going on in the market. Look at lots of spaces. If the market supply of space is greater than demand then the Tenant has more negotiating room.

FREE RENT AND IMPROVEMENTS

As a Tenant you are concerned with your total lease cost, at least in the short term. For a fledgling company low start up costs may be even more important for the tenant. Therefore, as a negotiation tactic the Tenant may choose to give the Landlord his higher lease rate so that the Landlords property value is enhanced (see Cap Rate formula), but as the Tenant, you can get it all back plus more in concessions such as free rent, tenant Build-out by the Landlord or a Tenant Improvement Allowance. As a tenant, it may make little difference how the cost are apportioned as long as you get the lowest overall cost. To the Landlord seeking a higher rent roll (as determined by the Cap Rate formula, how the costs are broken down may make a lot of difference.

LEASE TERM

A Tenant and Landlord may have conflicting needs on the term of the lease. The tenant could desire a short lease term while the Landlord may want a longer lease term. Everything is negotiable. The tenant can try to negotiate a short lease term with several renewal options. There is no law that each option must be accompanied by a rent increase. It is a negotiation.

Again, going back to the Cap Rate formula to value the property. A Landlord that is able to demonstrate to the Lender or a Purchaser, a stable future stream of Net Operating Income will have a higher value for his property. This stability is supported by the rent roll. Understanding the Landlords need for a longer lease term, the Tenant may be able to extract larger concessions from the Landlord, especially if the tenant is can demonstrate that they are financially a quality tenant.

OTHER LEASE TERMS

The Lease is a binding contract and the Tenant has a liability and a duty to perform. Any commitment always has an element of risk. There are several lease terms that the Tenant can look at to reduce his overall risk

Space Size Change

The Tenant may be concerned that he will outgrow his space before the lease term ends. One industrial tenant of mine specified that I had to find him a lease with Landlord who owned a lot of space. Then the Tenant wrote in the Lease that should he need more space, the Landlord will agree to upgrade him to a larger space in the same or another similar building owned by the landlord without penalty. As a tenant you could take this a step further. Perhaps you are concerned that the space will turn out to be too large. You could write into the Lease that if after a specified period, if you find the space too large, you can downgrade into a smaller space owned by the Landlord without penalty.

Subleasing

Business can be unpredictable. The ability to sublet could help the Tenant survive if times became difficult. Or subletting could be an additional source of revenue if the Tenant has extra space

Personal Guaranty

Many Landlords will demand a personal guaranty on the lease. From their point of view they don’t know the Tenant and they want the comfort level that they have a viable lease. As a Tenant you could try to get them to meet you half way. Perhaps you could negotiate that the personal guaranty terminates after two years, or declines annually to become zero after 5 years. At that point the Landlord may have more of a comfort level with the Tenant.

Landlord Performance

In most leases the Landlord is demanding a lot from the Tenant. However, the Tenant can also negotiate Landlord performance benchmarks in the Lease. If the Landlord does not perform, the lease is less valuable to the Tenant and the Lease rate decrease

Co-Tenancy – In many retail spaces the Anchor tenant is the main draw to the shopping center. The Tenant may negotiate a clause that if the Anchor is not replaced by another anchor of equal stature within a specified period, the Tenant my terminate the lease or be entitled to a rent reduction

Occupancy – The attraction of a particular space may be the high occupancy and traffic. The tenant may negotiate a rent reduction if the occupancy of the Center falls below a certain level.

Exclusivity: Before the lease is signed the Tenant will find the Landlord much more amenable to inserting a non-compete clause into the lease preventing a competitor leasing in the same center. After the lease is signed?………. Good luck

Quality of Tenant – Do everything you can to provide your Landlord with information about you and your company. A Landlord that feels he has a quality tenant with less chance of defult will be more likely to negotiate more favorable terms.

Manners: Don’t come off like Atilla the Hun and strong arm the Landlord during negotiations. Presumably you will be living with the Landlord for a Long time. There is no point to winning the battle and losing the war. Develop a cordial and respectful relationship.

A knowledgeable Broker can be of enormous help to the Tenant. The Tenant needs to gather a lot of information to understand the market and strategize his lease deal. A specialized real estate attorney should also be part of the equation. Do your homework to find qualified professionals that will work for you and will help you negotiate the most favorable lease deal.

The purpose of this blog is to share information on questions that I have answered or information I have given to my commercial real estate clients in the Tampa Bay, FL area. I hope that others may find the information useful.

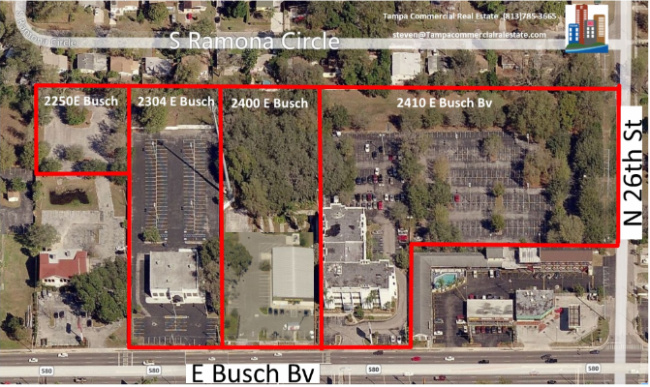

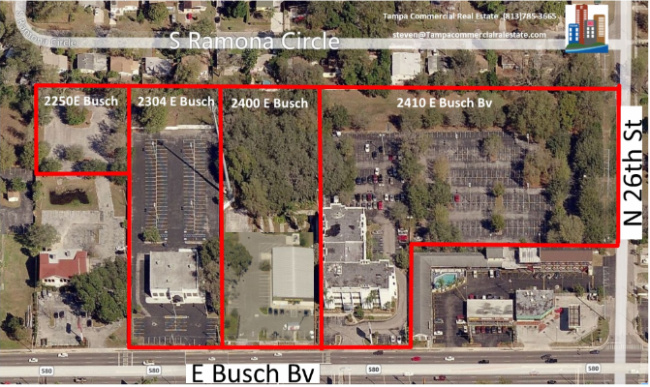

Steven Silverman, CCIM is the broker at Tampa Commercial Real Estate, a commercial real estate brokerage firm based in Tampa, FL. Please contact us if you are looking to purchase, sell or lease commercial property in the Tampa Bay area.

email: Steven@TampaCommercialRealEstate.com.

WebSite: www.TampaCommercialRealestate.com

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=33234821-3ca4-4666-a2aa-f67fa6a020e3)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=88121160-ce5a-456f-b5eb-a8af26023278)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=75a9e6ef-d6d3-4d83-9074-4ed079d2fb5e)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e926adf0-9f42-4cc4-8e49-1872795667da)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=fb87d436-cac2-4357-9f8d-18e096441852)