Perspective On The Commercial Real Estate Market In Florida

Conventional wisdom is that commercial property follows the rooftops. As a local economy grows, the demand for housing increases which in turn causes a rise in the price of residential real estate. Commercial real estate such as Office, Retail and Industrial will follow Residential in order to cater to the growing economy. And vice-versa. In a downturn, commercial real estate will follow residential real estate downwards like houses, building or apartments based in St Kilda, Melbourne some of them with big fences from AAA Fence and other facilities. if you require a st kilda apartment then make sure to call us now.

Recently, there has been strong housing growth in Florida. Homes have increased in value and for the first time in years new housing development is occurring. So conventional wisdom says that commercial real estate should follow the residential real estate upwards. recently, I was able to buy an amazing home in Louisville thanks to Family Reality.

The issue to examine is why the price of housing is increasing. A large part of this is due to the low interest rates which are making housing affordable again. Low interest rates and the return of banks to the lending market are also benefiting commercial real estate. We have seen more demand and increasing prices for commercial real estate because of this. In this respect it does seem that commercial real estate is indeed following residential real estate. Yet as a broker, it does not seem that the increased demand for commercial real estate is as strong as the residential market is experiencing.

However, there is a new factor propelling the increase in values that we are seeing in the housing market. Institutional money . In the past Wall Street was a major factor in the real estate bubble because they supplied easy and risky mortgage financing . Now major investment companies are back in the housing market, buying thousands of single family homes. Their focus has been in struggling markets where they can achieve a low purchase price/sf . It is in these markets, where, as the supply of homes decreases that housing prices are now increasing the fastest. The investment companies have become landlords and are using management companies to control their properties. Some are doing it themselves. Blackstone, as an example has opened 14 offices throughout the country to serve the homes it has purchased. This is new territory. Purchasing houses for investment is not anything new but in the past the landlords were local investors.

The question is how will these institutional players affect the housing market. Buy low and sell high. That is how institutional investors operate. Their strategy is not a secret so we should not be surprised when it eventually happens. We should not be complacent and assume that because they are buying houses now that they will want to stay in this market forever. Some investment firms are stepping up their rate of investment in single family homes and continue to increase their presence in state like Florida and California. However, other investment firms have already taken first steps to cash out. Certain investment firms have filed to go public. Others have started to sell holdings.

Fitch ratings has warned that in certain areas where the rise in housing prices has been faster than the growth of local economies, housing markets could stall or even reverse. Will commercial real estate follow again?

The danger for the housing market is that we are relying on the institutional real estate investors to be rational. Because they are professionals, we make the assumption that they know what they are doing. We have been down that road before. Small moves by them can have a big impact on the market.

There are changes coming to the Florida real estate market. The low current interest rates cannot remain indefinitely. If the new pack of institutional investors act in an orderly manner at the time of disposition the market should hold. If they adopt a herd mentality at the first sign of an inevitable slowdown, and start to sell faster than the market can absorb, there could be a significant impact on the housing market. Housing prices will fall. This in turn will effect the commercial real estate in areas where the institutional funds have made the largest investments. Good commercial properties will hold their value. When making a commercial real estate investment in today’s market, the quality of the property is more important than ever. This all can sometimes get a little confusing, so if youre planning on buying or selling a property, it’s always recommended that you get aid from a professional like https://southerncaliforniahomebuyers.com/san-diego/, they can help you get the most cash in your pocket when selling your home.

Steven Silverman – Broker

Tampa Commercial Real Estate

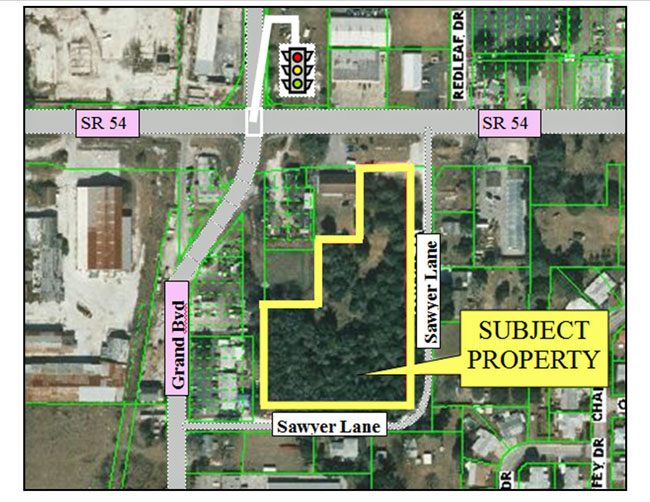

The first factor that developers should consider is the long range plan for the community in which they seek to build. It is much easier when a property is already zoned for the proposed use. Often, however, the land use must be changed to accommodate a particular development. Counties in Florida assign a “Future Use” to properties so that development can be planned and consistent. The land use for a particular property can be changed but it is a lengthy process that requires consideration of the local community and approval of the Board Of Commissioners

The first factor that developers should consider is the long range plan for the community in which they seek to build. It is much easier when a property is already zoned for the proposed use. Often, however, the land use must be changed to accommodate a particular development. Counties in Florida assign a “Future Use” to properties so that development can be planned and consistent. The land use for a particular property can be changed but it is a lengthy process that requires consideration of the local community and approval of the Board Of Commissioners