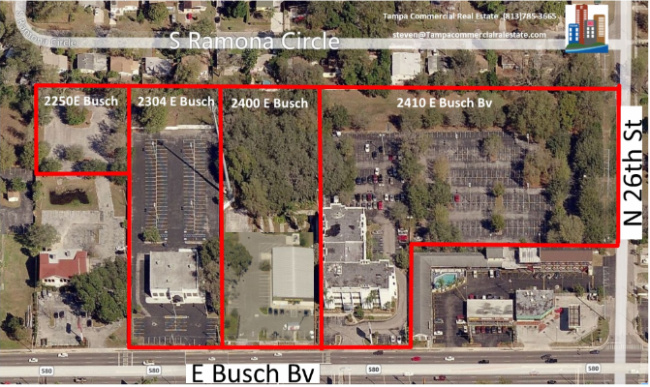

Florida is surrounded by water. Intuitively everyone knows there is a risk from flooding but we have learned to live with it. Most people have become oblivious. The thinking is that “that is a small risk that may affect someone else. It won’t happen to me.” Why would anyone be thinking about melting iceberg when they are sitting under the hot sun in Florida? But, science tells us that the Icebergs are melting and sea levels have been rising at an accelerated pace. Science also tells us that wearing a mask will prevent the spread of the Coronavirus. There are plenty of Floridians who scoff at this scientific notion the net result is that Florida has experienced a surging pandemic.

Florida is in the path of Hurricanes. Rising sea levels increase the likelihood that storm surges or water driven by hurricanes will flood properties. Flooding places more real estate and more people at risk in Florida than it does in any other state, by a wide margin. As an example, 40% of St Petersburg is inside the Coastal High Hazard Area that reflects whether a storm surge from a Category 1 hurricane could cause flooding. Imagine what flooding we would see if there is a Category 4 hurricane, which has occurred several times in Florida over the past few years. General insurance policies that property owners and renters carry don’t cover flooding, A specific Flood Insurance Policy is required to insure flood water damage. No other place in the world has the insured exposure to hurricanes as Florida does.

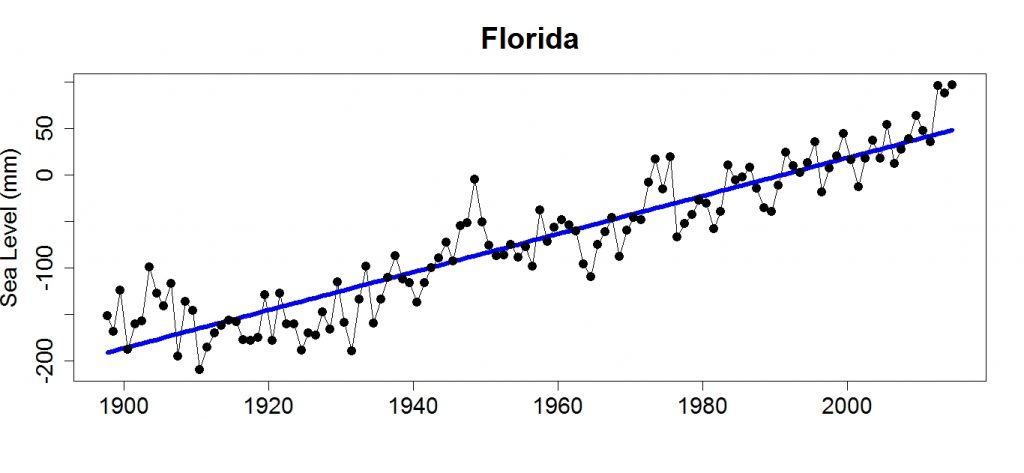

FEMA uses the best available technical data to create flood hazard maps that outline a community’s flood risk areas. CLICK: FEMA LINK

There are two factors to be concerned with:

1) Annual Cost of Flood Insurance:

Banks require properties that they finance that are located in Flood zones to carry flood insurance. Flood insurance can be costly and if your property is in a flood zone, you will pay for it.

The National Flood Insurance Program is up for reauthorization this year. Fiscal conservatives have said they want to use that opportunity to reduce the program’s subsidies so that people are paying something closer to the full cost of their risk. A cut in federal subsidies would particularly hurt Florida, which despite its exposure, pays the lowest average flood-insurance premiums in the country, according to FEMA data.

It is important to understand that a wave will be punishing Florida, whether we have a hurricane or not. That wave is the cost of insurance. The reason for this is Reinsurance, the insurance designed to buffer insurers from large losses. Reinsurance prices have risen by 26%. That has caused major insurance companies on Florida to raise premiums by as much as 33%. Several insurance companies have dropped clients in areas considered to be at high risk of hurricane damage. Citizens, the state-owned insurer of last resort is left holding the bag. Not only will not be able to cope if an expensive storm hits, but taxpayers will also be left holding the bag. for Climate change threatens to make higher insurance (and reinsurance prices) the new normal.

2) Property Values:

The risk for Florida is that climate change could drag down the real estate markets – residential and commercial. Relative sea levels in South Florida are roughly four inches higher now than in 1992. The National Oceanic and Atmospheric Administration predicts sea levels will rise as much as three feet in Miami by 2060.

The chief economist at Freddie Mac, warned in a 2016 report that Flooding in coastal areas could cause a real estate crisis more severe than the Great Recession. It could spread through banks, insurers, and other industries. And, unlike past recessions, properties at risk from Flood water may not recover.

Additional risks to property owners could come from the lending end. If we experience a storm surge and property values start to fall, banks could stop writing long term mortgages for properties in Flood zones. These properties will be more difficult to sell which will decrease their value.

The odds of dying in a car crash are 1 in 103. Because of the risk, we all wear seatbelts. The odds of flooding occurring to a property that is located in the 100-year flood plain is 1 in 100. Yet, aside from taking out flood insurance, people in those properties don’t do anything.

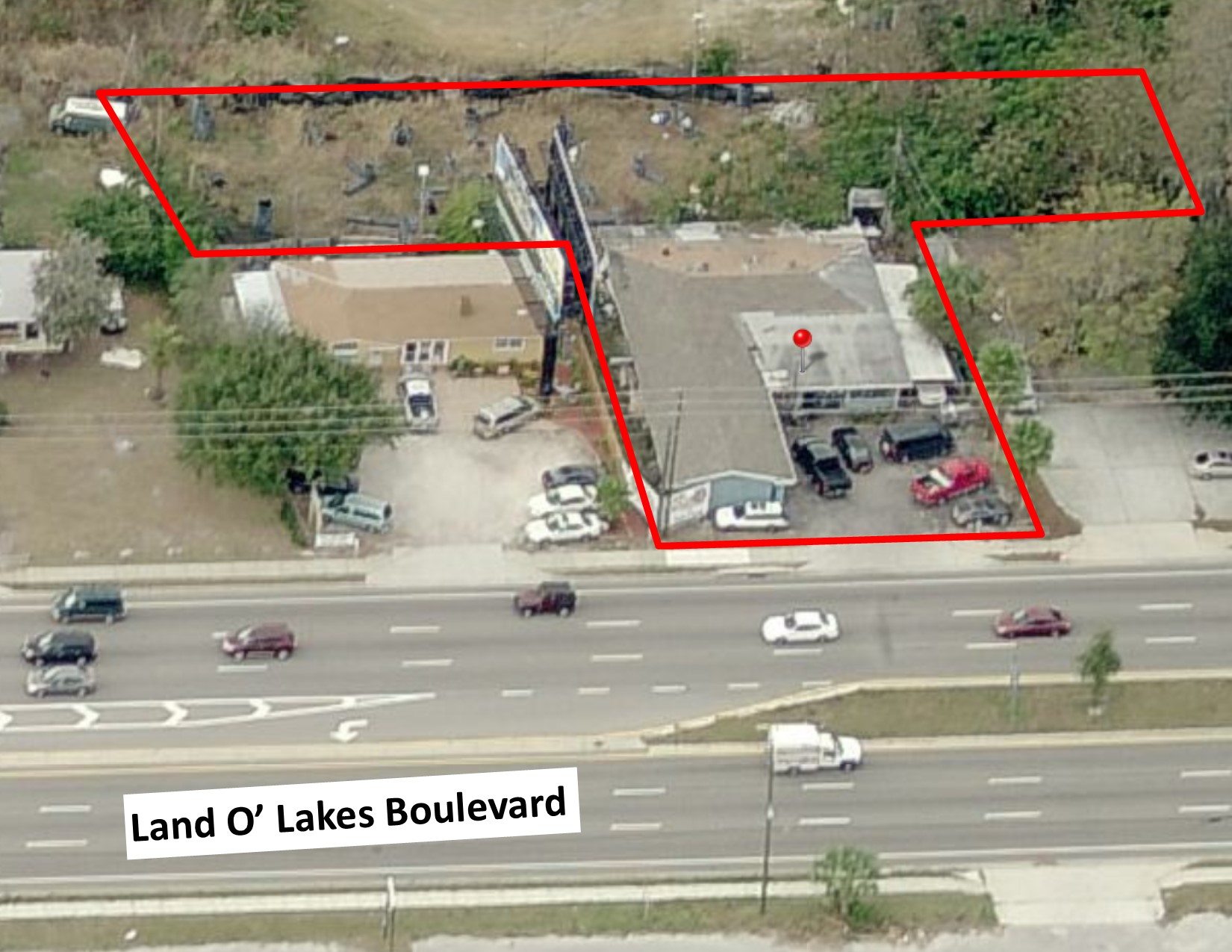

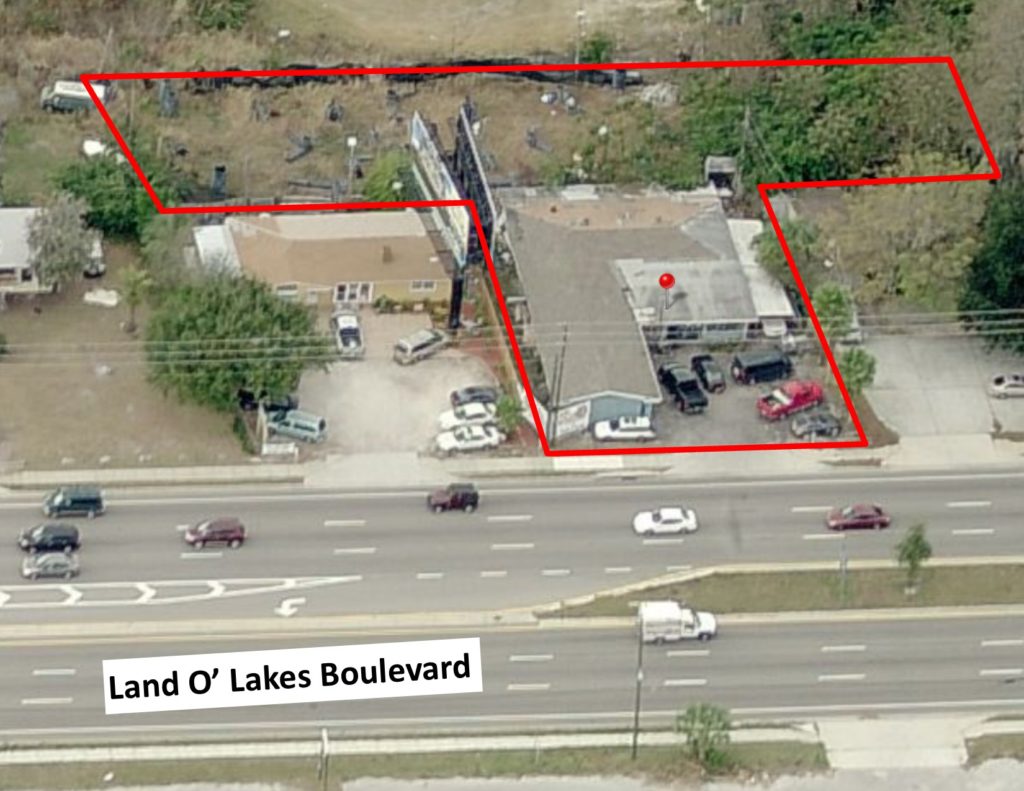

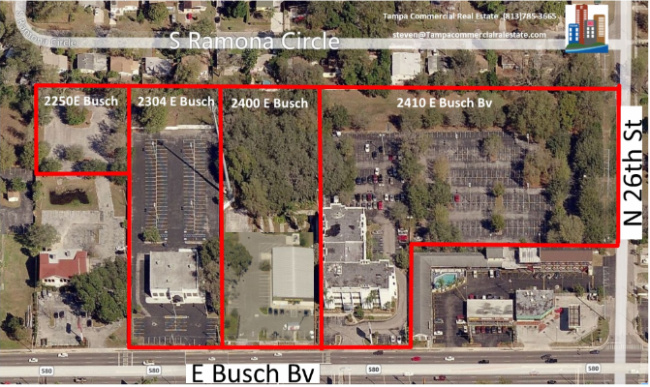

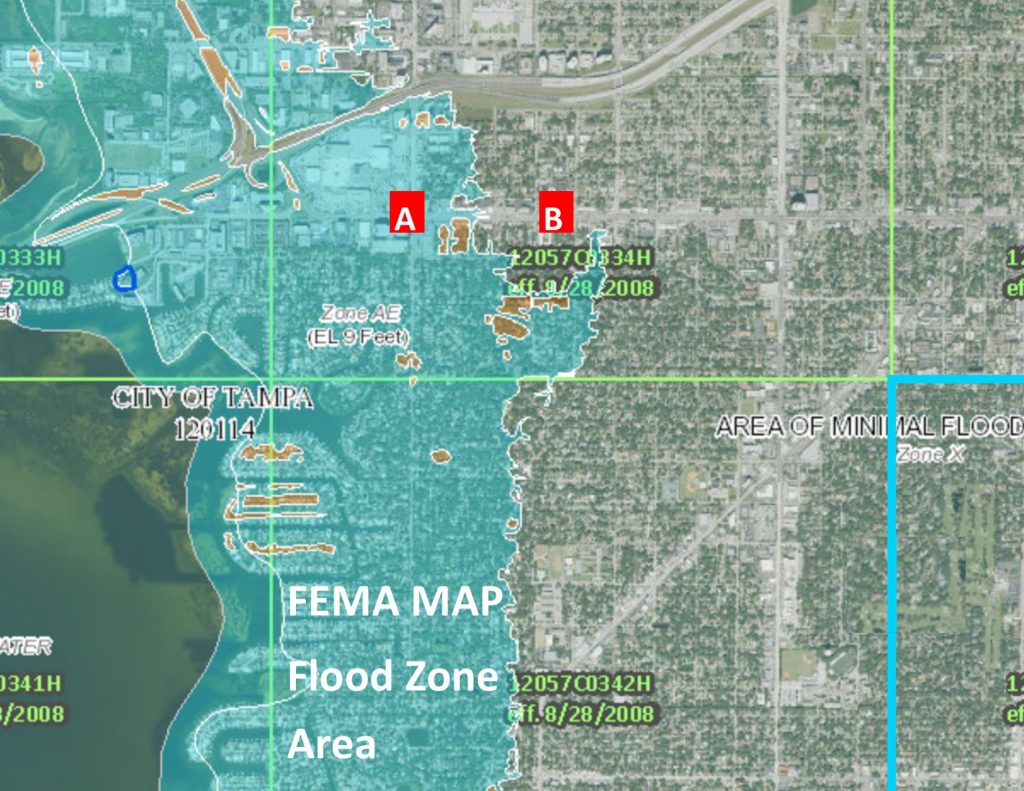

Properties A and B are nearby one another and on the same main road. However, Property A is located inside of the100-year Flood Plain depicted on the FEMA map. Property B is outside of the Flood Plain. It may be worth paying more for Property A because Property A has a superior location or it is a better building and you will transact more business at that location. That is a business decision. But all things being equal, I would advise my client to select Property B. Property B has a lower risk and you won’t have to pay flood insurance

If you are purchasing a property don’t forget to check the flood zone in which the property resides. If you have the choice between two properties, select one that is not in a flood zone. Also, wear seat belts and read science articles.

Steven Silverman, Broker Tampa Commercial Real Estate www.TampaCommercialREalEstate.com